We understand the financial sector

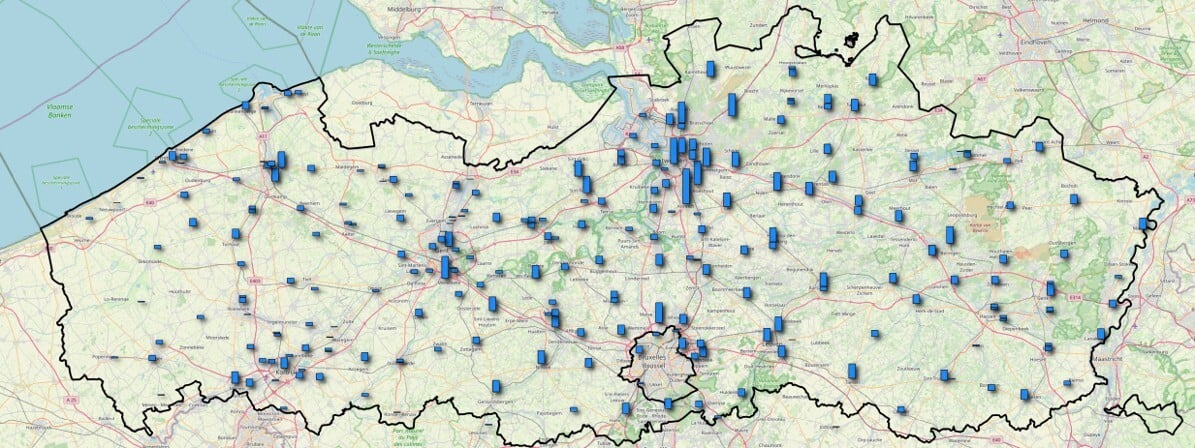

The banking industry is undergoing a digital transition, with a growing number of services being transferred from the branches to ATMs and digital channels. Almost all banks are currently closing branches and are downscaling services in their branches in a targeted manner. RetailSonar knows exactly what you should do, with an amazing array of proven predictive models and instruments.

Smart location decisions. Maximum ROI.

Thanks to curated, best-in-class data, a revolutionary AI model and a passionate team, you can use our platform to make your location decision with confidence, precision and in just a few clicks.

Plan your optimal location network with confidence

Design your most profitable network and plan openings, closures and relocations. With the highest possible accuracy.

Easily improve the performance of your locations

Sales teams can pinpoint the revenue their locations should be making, alongside the right actions to take. In just a few clicks.

Optimize the efficiency of your marketing efforts

Have marketing teams craft precise activation and retention campaigns to ensure they achieve the best ROI. In an easy-to-use platform.

An optimum branch network, in digital times

- Analyze the future impact of digital services on your branch network

- Optimize the current branch network. Which branches can close without a major impact on customer turnover?

- Optimize your current service offering for every branch. Offer the right services to the right customers in the right location. Take into account all the relevant parameters in your customer database. Refine the optimum mix, by taking into account your customers’ need for advice, whether they are private individuals or corporate customers.

- Limit customer turnover when closing a branch. Predict future needs in terms of capacity and opening hours of your remaining branches. Redistribute your employees and customers in the best possible way, across your remaining branches.

- Include your network of competitors and their campaigns in your optimum plan. Their actions can have a major impact on your future network. So always keep up to data with robust instruments and reporting.

- Plan new branches in uncharted territory with high recruitment potential (blind spots and hotspots). Forecast the possible sales, the cannibalisation of existing locations and choose your location smartly by factoring in the existing, ideal neighbours, social-demographical data, traffic and effective travel times.

- Use a predictive risk management tool which takes into account local market characteristics.

Optimum branch performance

- Get everything you can out of your existing and future branch footprint.

- Generate more revenue/sales in existing branches, through a better insight in the local market potential, local customer behaviour, visitor figures and the branch’s neighbours.

- Measure the current waiting times and delivered service levels for visitors to the ATMs and branches, based on historical arrival patterns and waiting queue theory models.

- Design the optimum capacity per branch in terms of staffing and ATMs, taking into account the full future potential of a branch and the service level objectives for customers.

Optimize your marketing campaigns

- Convey the right message about the right services to the right customer.

- Understand the needs of your clientele, by defining your customers’ DNA and linking this, along with your existing data, to the RetailSonar models.

- Optimize your campaigns with better targeting and geo-segmentation

- Constantly increase the ROI of your campaigns by better monitoring the results, analyzing the results in more detail and making changes where necessary.

“We are optimizing our entire branch network with greater confidence and certainty.”

Features relevant to the industry porta laoreet

Performance Academy | Maximize your current location performances (entry level)

Take your network performance to the next level with this beginner-friendly session, designed to identify opportunities and catch...

Performance Academy | Maximize your current location performances (entry level)

Take your network performance to the next level with this beginner-friendly session, designed to identify opportunities and catch...

Performance Academy | Maximize your current location performances (entry level)

Take your network performance to the next level with this beginner-friendly session, designed to identify opportunities and catch...

Book a meeting with our retail expert and maximize your ROI

Discover how you can optimize your location strategy by making the smartest location decisions.