Flanders Among Europe’s Front-Runners in EV Adoption in 2025

Over the past two years, RetailSonar, co-financed by the European Regional Development Fund (ERDF) and the Flemish Agency for Innovation and Entrepreneurship (VLAIO) with a budget of 395 000 euros, has analyzed electric charging needs and validated them with various stakeholders. One key conclusion stands out: Belgium currently ranks among the European leaders in electric passenger vehicles, with Flanders performing above the national average. At the same time, there are major differences between municipalities, and significant additional charging capacity will be required in the coming years.

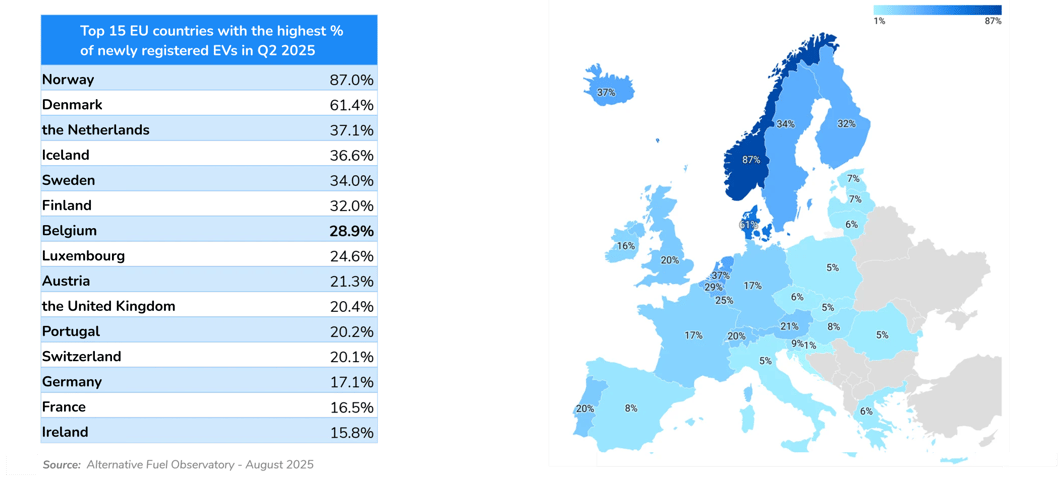

Despite the recent easing at European level of the ban on internal combustion engine vehicles from 2035 onward, Flanders continues to move steadily toward greater e-mobility. According to figures from the European Union (AFIR), 29% of newly registered cars in Belgium are now fully electric. Compared to the European target of 20%, Belgium is therefore performing better than expected and ranks just behind leading regions such as Scandinavia and the Netherlands.

Flanders outperforms the national average. In 2024, 34% of newly registered passenger cars in the region were electric. As a result, 574 787 passenger cars are already driving in Flanders either fully electric or as plug-in hybrids. This represents around 8.5% of the total Flemish vehicle fleet. Based on current market forecasts, this number is expected to more than double by 2030 if growth continues at the same pace.

An Additional 39% of Public Charging Capacity Needed by 2030

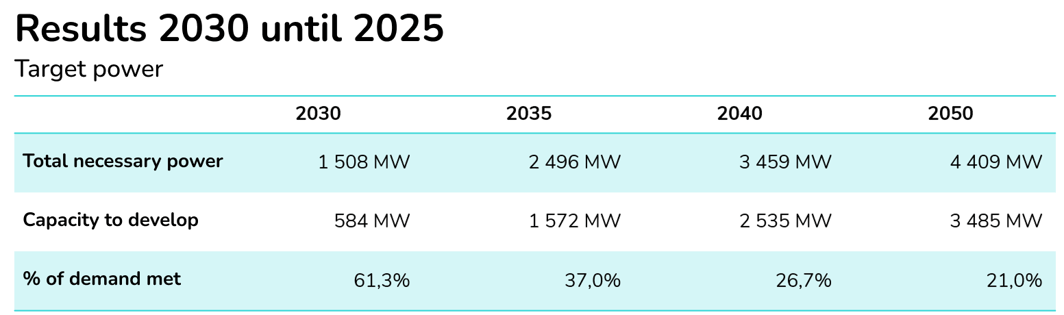

Flanders is generally on track when it comes to deploying charging infrastructure. Still, a substantial expansion will be required to meet future demand. Today, the region has around 68 000 public charging points, representing a total charging capacity of approximately 924 MW. This capacity is broadly sufficient to meet current charging demand.

However, it will not be enough to accommodate the rapid growth of the electric vehicle fleet in the years ahead. Based on current projections:

-

With the existing charging capacity, around 61% of expected charging demand will be covered by 2030.

-

An additional 39% of charging capacity will therefore be required to be ready by 2030.

-

Looking further ahead, by 2050, around five times more charging points will be needed compared to today if the current trajectory continues.

Large Differences Between Municipalities, and Within Them

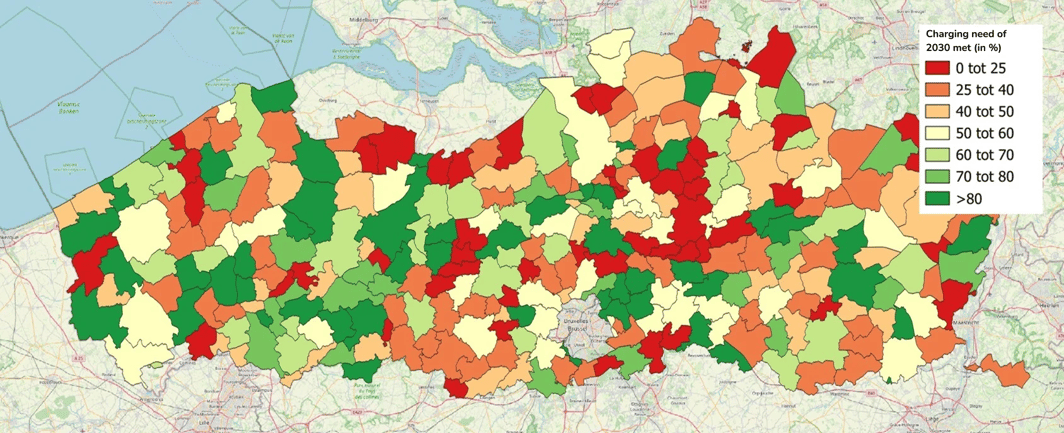

RetailSonar calculated the minimum charging requirements for 2030 for each municipality and compared them with the existing infrastructure. This made it possible to determine the share of the 2030 charging need that is already covered today for each municipality.

Figure: % of charging capacity fulfilled vs 2030 needs

Download the results of the EFRO study [Dutch]

The results clearly show where charging needs are most pressing, down to the neighborhood level:

-

As of July this year, 51 out of 300 municipalities had installed less than 25% of their minimum charging requirement for 2030.

-

By contrast, 18 municipalities have already installed nearly all of the charging capacity required for 2030. For these municipalities, future deployment will need to be carefully planned to remain ready beyond 2030.

-

Several larger cities, such as Ghent, Mechelen, and Hasselt, are also performing well.

Neighborhood-Level Analysis Remains Essential

The Flemish government encourages cities and municipalities to deploy standard charging infrastructure on their own sites. Through public concessions, more than 9 588 charging points have been installed in recent years, with additional concessions planned for the coming years.

At the same time, it remains essential to ensure a balanced distribution of charging points within each municipality. This requires analyzing actual charging needs neighborhood by neighborhood.

Even for municipalities that are currently on track, it remains important to use available data to identify where needs are greatest and to ensure a balanced and well-planned rollout of charging infrastructure across all neighborhoods.

Co-funded by the European Union and Vlaio in the amount of 395k EUR