Optimize your property investment strategy

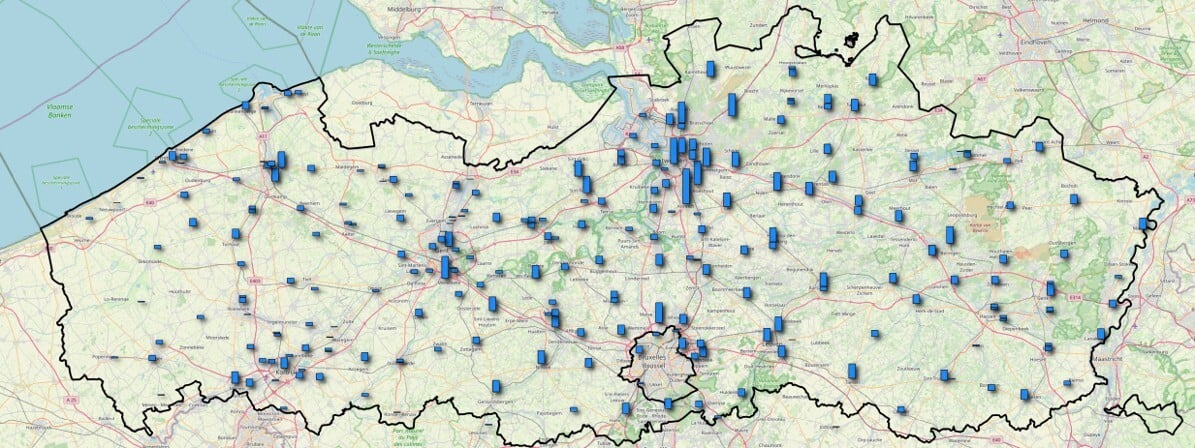

Retail real estate investors must balance risk, return and long-term value. Choosing the right locations — and understanding local market dynamics — is key to securing stable rental income and asset appreciation. Data-driven insights help you make confident decisions about acquisitions, portfolio upgrades and redevelopment.

Smart location decisions. Maximum ROI.

Thanks to curated, best-in-class data, a revolutionary AI model and a passionate team, you can use our platform to make your location decision with confidence, precision and in just a few clicks.

Plan your optimal location network with confidence

Design your most profitable network and plan openings, closures and relocations. With the highest possible accuracy.

Easily improve the performance of your locations

Sales teams can pinpoint the revenue their locations should be making, alongside the right actions to take. In just a few clicks.

Optimize the efficiency of your marketing efforts

Have marketing teams craft precise activation and retention campaigns to ensure they achieve the best ROI. In an easy-to-use platform.

How we help retail investors

Make strong investment decisions, quickly

- View the available market space by combining market data (including household budgets) and take into account existing stores, competitors, and the minimum ROI.

- Identify location performance opportunities: which stores are not yet maximizing their sales potential? Which stores can perform better with minimal investment?

- Determine the growth potential that the market is offering the retailer. What are the hotspots for new locations? And what potential is actually still within reach?

- Calculate the synergy with online: what is the exact added value of the physical stores for the online turnover (halo effect)?

Maintain a grasp in a highly disruptive market

- Regularly monitor the sales channels' and stores’ internal developments

- Stay informed about all the relevant market developments such as changes in consumer spending patterns, competitors, perfect neighbours, traffic, etc.

- Provide clear quarterly reporting via a structured dashboard

In the event of an exit, provide clear prospects for the future

- Make visual and substantiated statements about the future prospects for the retailer

- This ensures maximum valuation of the shares in an exit decision

- Deliver data-driven answers to strategic business issues with the RetailSonar platform: a sustainable decision support platform

Performance Academy | Maximize your current location performances (entry level)

Use transparent, fact-based insights to choose the right ass

“Thanks to RetailSonar, we avoid internal uncertainties and subjective estimations.”

Strengthen your retail investment portfolio

Use transparent, fact-based insights to choose the right assets, optimize returns and reduce uncertainty. Make decisions that support long-term value creation.

Book a meeting with our retail expert and maximize your ROI

Discover how you can optimize your location strategy by making the smartest location decisions.